How GDP, Inflation, Central Bank Policies, and Economic Events Shape Currency Strength—with Sentiment & CoT Analysis

Understanding what drives currency strength is fundamental for forex traders. This blog post delves into how GDP, inflation, monetary policy, and economic events influence exchange rates—and how to interpret market sentiment and the Commitment of Traders (CoT) report to inform smarter trading decisions.

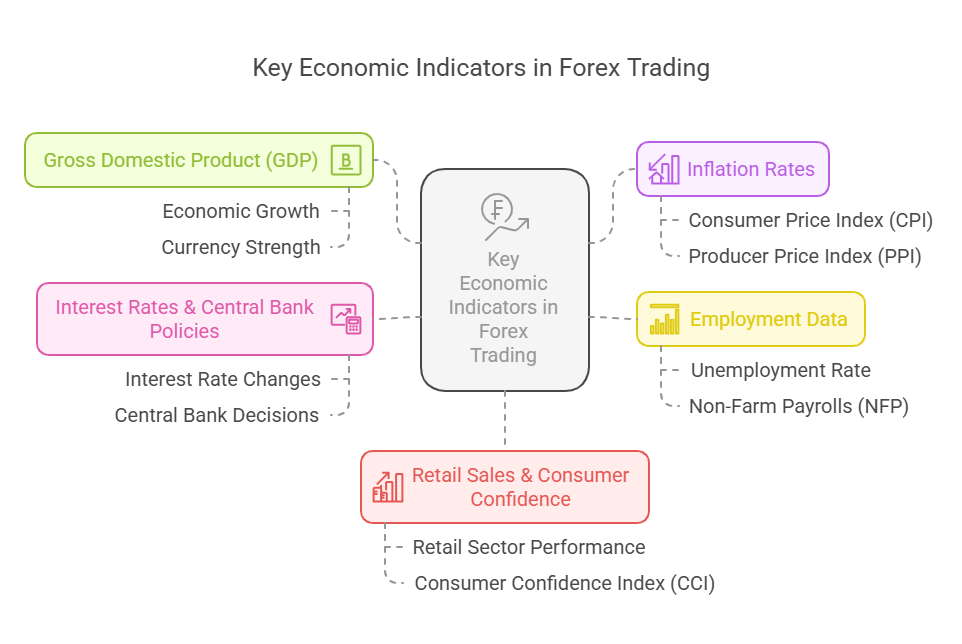

1. Economic Fundamentals: The Core Drivers

GDP: A Measure of Economic Power

- GDP quantifies a nation’s economic activity. High GDP growth often indicates a strong economy, which can attract foreign capital and strengthen its currency. Investopedia

- Traders closely observe GDP releases (advance, preliminary, final) to anticipate interest rate adjustments and currency reactions. Investopedia

Inflation: The Price Stability Gauge

- Inflation erodes purchasing power. If inflation climbs too fast, central banks may hike rates—often strengthening the currency. Investopedia+1

- High inflation typically weakens a currency unless countered by aggressive monetary tightening. Investopedia+1

Central Bank Policy: The Currency Commander

- Central banks set interest rates, control money supply, and, during crises, deploy tools like quantitative easing (QE). Opo FinanceInvestopediaWikipedia

- Rate hikes tend to strengthen a currency; rate cuts and QE generally weaken it. Opo FinanceWikipediaInvestopedia

Economic Events: Immediate Catalysts

- Macroeconomic reports (e.g., inflation, employment, GDP) can trigger short-term volatility. Forex traders use economic calendars to stay prepared. Trading 212Investopedia

- Markets often move in line with surprises—better-than-expected data boosts the currency; worse-than-expected data drags it. Trading 212

2. Market Psychology: Sentiment & the CoT Report

Sentiment Analysis: The Crowd Factor

- Sentiment reveals the collective mood of traders—optimistic (bullish) or fearful (bearish)—and can precede actual price moves. E8 Markets BlogInvestopedia

- Tools like sentiment indicators and news analysis help gauge prevailing market emotion. E8 Markets Blog

The Commitment of Traders (CoT) Report

- The CoT report, published weekly by the CFTC, tracks the positioning of institutional, commercial, and retail traders in currency futures. It acts as a sentiment proxy. insider-week.comInvestopedia

- Extreme positioning—such as overly bullish or bearish sentiment—often precedes market reversals. Investopedia

3. Currency Strength: Where Fundamentals and Psychology Meet

Key Influencers of Currency Strength

- A currency’s strength is influenced by GDP growth, interest rate differentials, inflation, and trade dynamics. AvatradeWikipediaInvestopedia

- High interest rates and sound economic indicators tend to attract capital, boosting currency strength. Investopedia+1Opo Finance

- Inflation acts inversely to strength; stable, low inflation supports a currency, while high inflation often signals weakness. Investopedia+1

4. Bringing It All Together: A Unified Analysis Framework

| Analysis Component | How It Impacts Currency Strength |

|---|---|

| GDP & Growth | Indicates economic strength; higher growth supports currency |

| Inflation | High inflation weakens currency; low inflation strengthens |

| Central Bank Policy | Rate hikes/QE impact demand for the currency |

| Major Events | Surprises (CPI, GDP, employment) spark volatility in FX pairs |

| Sentiment | Crowd mood influences movement; extremes hint at reversals |

| CoT Report | Institutional positioning provides context to sentiment |

Trading Tip: Use fundamentals to establish direction, then confirm setups with sentiment and CoT signals for timing and risk management.