Mastering Market Moves: Proven Trading Strategies for Consistent Profits

Mastering Market Moves: Proven Trading Strategies for Consistent Profits

In the fast-paced world of trading, profits don’t come from luck—they come from strategy, discipline, and consistency. While anyone can open a trading account and place a trade, only those who master their strategies and adapt to changing markets achieve long-term success.

In this post, we’ll explore proven trading strategies that can help you master market moves and build consistent profits, whether you’re trading forex, stocks, or cryptocurrencies.

1. Develop a Clear Trading Plan

Every profitable trader operates with a trading plan—a set of rules that guide entries, exits, risk management, and position sizing. Without a plan, emotions like fear and greed take over, leading to impulsive decisions.

Your trading plan should include:

- Preferred markets (e.g., forex, stocks, commodities)

- Timeframes (scalping, day trading, swing trading)

- Entry/exit rules

- Maximum risk per trade (usually 1–2% of capital)

A clear plan creates structure and prevents random trading.

2. Master Risk Management

No strategy works without risk control. Even the best traders experience losses, but what separates them from amateurs is how they manage risk.

Some golden rules of risk management:

- Never risk more than 1–2% of your account per trade

- Always set stop-loss orders to protect capital

- Use proper position sizing instead of overleveraging

Remember, preserving capital is more important than chasing profits.

3. Use Trend-Following Strategies

The saying goes: “The trend is your friend.” Identifying and trading with the trend increases your probability of success.

How to trade with trends:

- Use moving averages (50-day & 200-day) to confirm direction

- Look for higher highs in uptrends and lower lows in downtrends

- Combine with volume analysis to validate momentum

Trend trading reduces noise and allows you to ride big market moves.

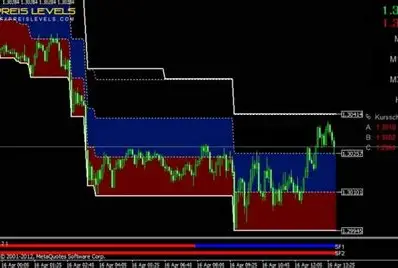

4. Apply Breakout Trading

Markets often move sideways before breaking into strong trends. Breakout trading helps traders capture these explosive moves.

Tips for breakout success:

- Identify key support and resistance zones

- Watch for breakouts on high volume (a sign of strong interest)

- Place stop losses slightly below/above breakout levels

Breakouts often mark the start of major market shifts—catching them early can yield big profits.

5. Keep Emotions in Check

Even with strong strategies, emotional trading can destroy results. Fear leads to early exits, while greed pushes traders to overtrade.

Ways to control emotions:

- Stick to your trading plan

- Journal every trade to track mistakes and improvements

- Take breaks after wins and losses to avoid impulsive trades

Discipline is the hidden strategy that separates consistent winners from constant losers.

6. Backtest and Adapt

Markets evolve, and so should your strategies. Regularly backtest your methods on historical data and adapt to new market conditions.

Backtesting helps you:

- Spot weaknesses in your strategy

- Build confidence before going live

- Understand how your system performs in different markets

Final Thoughts

Mastering market moves isn’t about chasing the latest indicator or secret formula. It’s about combining proven strategies with risk management, discipline, and continuous learning.

Trading is a journey. If you stay committed to mastering your craft, you’ll move closer to achieving consistent profits in the markets.