Backtesting Forex Setups: Walkthroughs, Entries & Exits, Plus Real Trade Analysis

Effective forex trading isn’t just about instinct—it’s about consistency. The key lies in backtesting, mastering your entries and exits, and learning from real trades. Here’s a comprehensive, SEO-optimized blog post to guide your readers through the process.

1. What Is Backtesting—and Why It Matters

Backtesting applies a trading strategy to historical data to simulate performance, offering a risk-free way to test effectiveness. It helps reveal strengths, weaknesses, and confidence in your approach before trading real capital.TradecietyQuantInsti Blog

Backtesting benefits include:

- Rapid understanding of a strategy’s behavior

- Identification of optimal settings and timeframes

- Development of confidence in your edge through consistent testingTradeciety

2. How to Backtest: A Step-by-Step Walkthrough

Step 1: Define Your Strategy

Clarify the rules: pair, timeframe, conditions for entry and exit, stop-loss, take-profit, and risk parameters.Trade with the Pros

Step 2: Choose Your Platform

- TradingView: Use “Bar Replay” to step through trades visually—excellent for manual strategy testing.HowToTrade

- MT4/MT5: Strategy Tester tool enables automated and manual backtesting.HowToTrade

Step 3: Record Your Trades

Use a simple spreadsheet to log:

- Date, timeframe, instrument

- Entry and exit points

- Strategy used

- R-Multiple, win/loss, and notesQuantInsti Quantitative Learning Pvt Ltd

Include screenshots to document your setup and trade management.

Step 4: Analyze Metrics

Evaluate:

- Win rate

- Profit factor

- R-Multiple average

- Max drawdown

- Equity curve smoothnessTrade with the Pros

Step 5: Optimize and Validate

Adjust parameters only when necessary; beware of curve-fitting. Validate on out-of-sample data and forward test via paper trading.Investopedia

3. Illustrative Example: Backtesting a Breakout Strategy

Let’s say you test a breakout strategy on EUR/USD using a 1:2 risk-reward ratio.

- Backtest 50 trades on a 4-hour chart using TradingView.

- Log each trade in your spreadsheet with screenshots at entry and exit.

- Analyze: If you win 60% with decent average returns and manageable drawdowns, the strategy has potential.

- Validate using unseen data to ensure robustness.

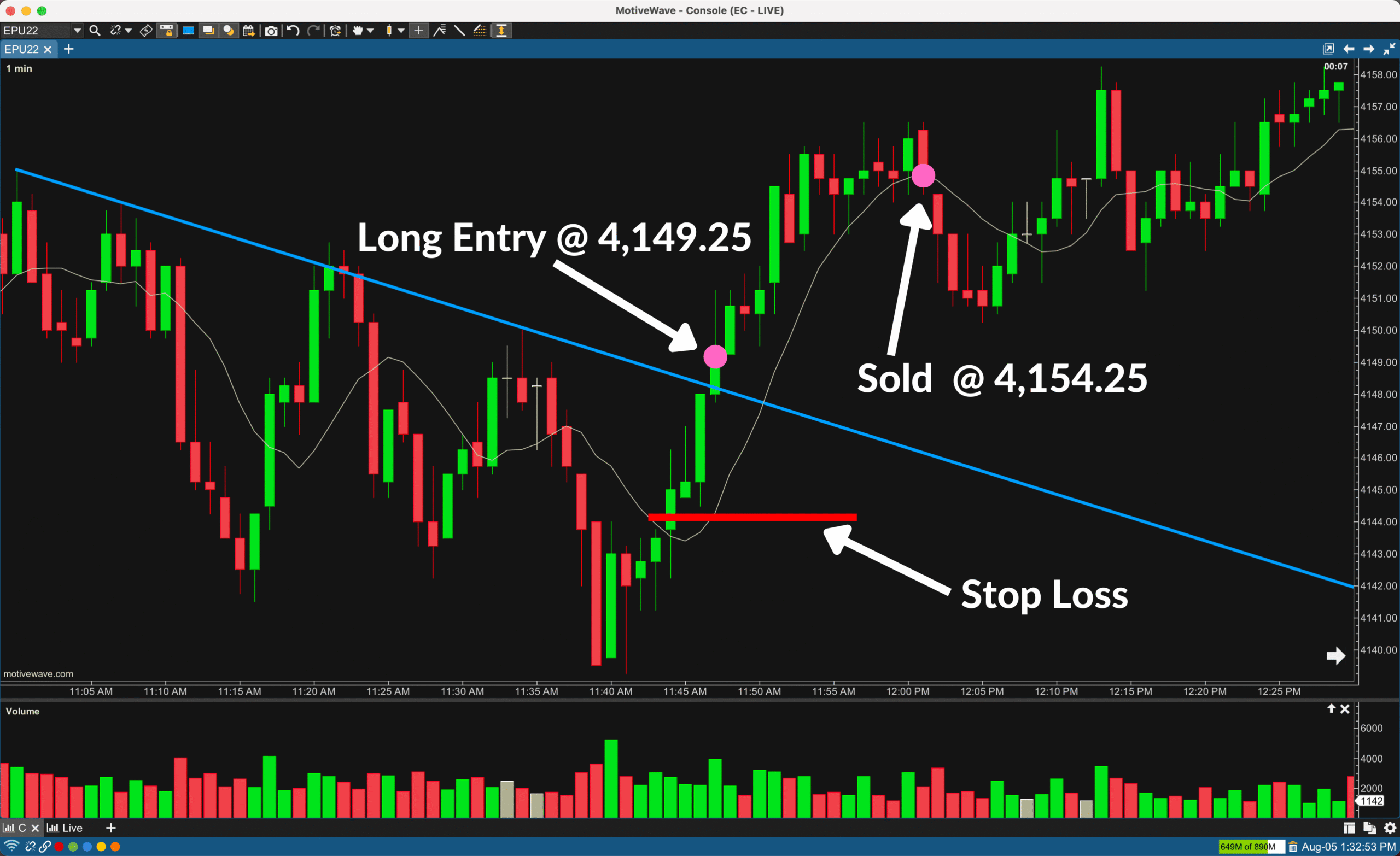

4. Real Trade Walkthrough: Wins & Losses

Sample Win:

- Pre-defined setup triggers an entry.

- Screenshot confirms entry level.

- Exit hits take-profit—log profit and capture screenshot.

Sample Loss:

- Trade captures early entry but reverses—stop-loss triggers.

- This is logged, screenshot captured, and serves as a learning point for future adjustment.

Share both examples to illustrate strategy consistency and risk control.

5. Why This Framework Works: Insights from Professionals

Professional traders rely exclusively on strategies proven through backtesting. They understand that successful trading is about playing the long game with an edge, not individual wins. Quantified Strategies This approach fosters confidence during drawdowns and prevents emotional bias. Backtesting turns theory into actionable, evidence-based strategy. By walking through setups, documenting trades, analyzing results, and validating with out-of-sample testing, you move from guesswork to edge-based trading.