Mastering Forex Psychology: Mindset, Discipline, and Smart Use of Leverage

Forex trading isn’t just about charts and indicators—it’s a high-stakes game that challenges your mindset and discipline. In this blog, we’ll explore how emotional control, a strong mental framework, and prudent leverage choices are essential to long-term trading success.

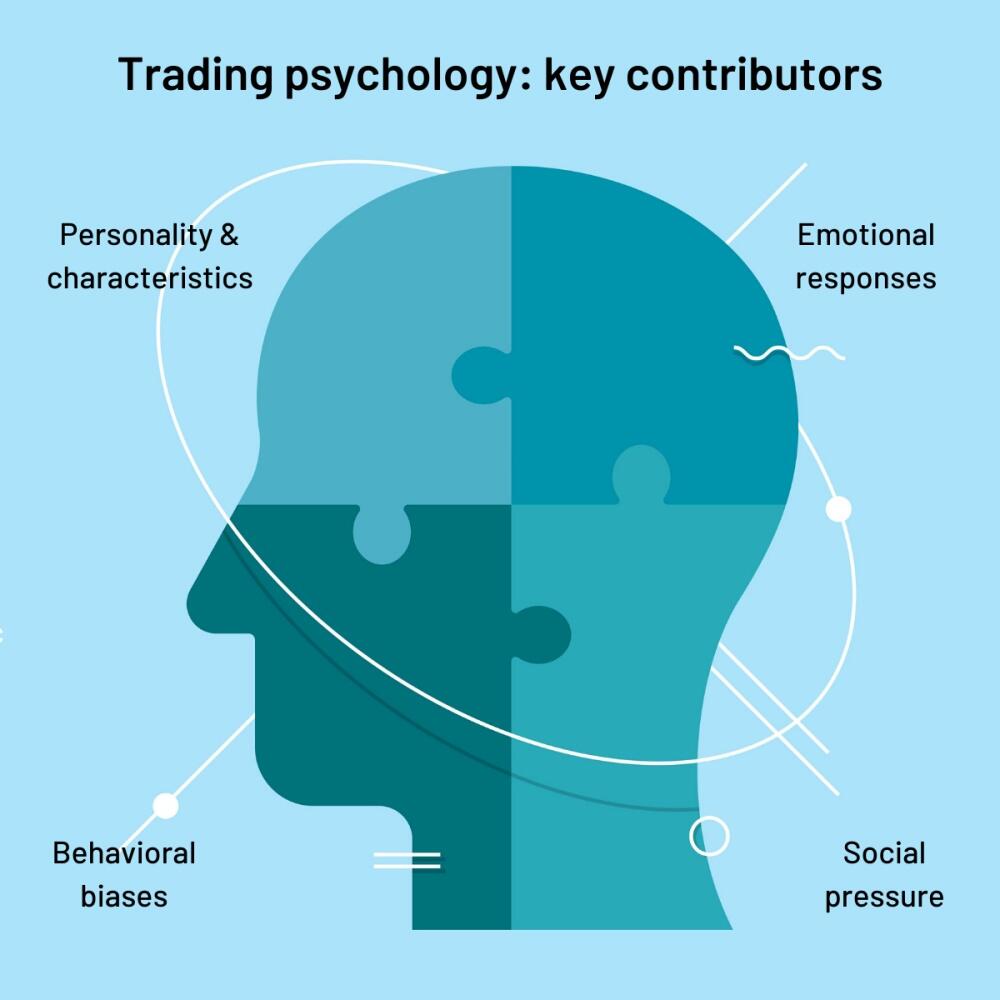

1. The Power of Trading Psychology & Emotional Discipline

A sharp strategy without mental control is like a sailboat without a sail—it won’t get far.

- Emotional discipline helps you stick to your trading plan, resisting impulsive decisions driven by market noise or shifting moods.PineConnector

- Lack of discipline often leads to deviating from proven rules—even when the plan is solid—which is a key reason traders fail.Ox Securities

- Beware of revenge trading: After a loss, traders sometimes take reckless positions in an attempt to “get even.” This behavior usually leads to even bigger losses, broken plans, and emotional burnout.plancana.com

Psychological Traps to Avoid:

- Letting Sorrow lead to rash trades (“fight or flight” mindset)

- Ignoring risk management post-loss

- Over-leveraging as a shortcut to recovery

2. The Leverage Dilemma: Amplifier of Gains… and Losses

Leverage is powerful—but misused, it’s a double-edged sword.

- Forex brokers commonly offer leverage as high as 50:1 to 100:1 or more, allowing you to control large positions with minimal capital.InvestopediaDaily Price Action

- However, high leverage magnifies losses just as it magnifies gains, making even small adverse moves potentially devastating.Investopedia+1Schwab Brokerage

- Regulatory limits vary:

- In the U.S., major pairs capped at 50:1, minors lower.DailyForexWikipedia

- In Europe, limits range from 30:1 (majors) down to 2:1 (cryptos).Wikipedia

- Retail traders must tread carefully; unchecked leverage—like 1000:1—can result in margin calls or full account blowouts.Wikipedia

Wise Practice: Lower your leverage—even to 20:1 or 10:1—to protect your capital and nerves.Daily Price Action

3. Emotional Discipline & Leverage: The Intersection of Psychology and Risk

- Effective discipline means choosing leverage that aligns with your psychological comfort. Even more so than capital, emotional resilience defines whether you can let a trade breathe or exit prematurely.

- Managing leverage responsibly is part of a broader risk management strategy, including setting realistic stop-losses and preserving mental composure.Exclusive Marketsfxdd.com

- Mindfulness, journaling mistakes and wins, and limiting exposure per trade—perhaps risking no more than 1–2% of your account—can safeguard your mindset under pressure.plancana.com

4. Summary Table: Core Principles at a Glance

| Element | Why It Matters | How to Manage It |

|---|---|---|

| Mindset & Discipline | Prevents emotional trading, like revenge trades or overtrading | Follow a plan, journal trades, reflect post-session |

| Leverage | Amplifies profitability—but also risk | Use conservative ratios (10–20:1), adjust gradually |

| Risk Management | Helps preserve capital and reduce emotional distress | Define position size, set stop-losses, cap risk at ~1–2% |

| Emotional Triggers | Losses can trigger destructive behavior if unaddressed | Identify triggers, pause trading, reset focus |

rading is as much about what happens inside your mind as it is about external market movements. Sustainable success demands:

- A disciplined mindset that overrides emotions

- Prudent use of leverage to amplify gains carefully, not recklessly

- Robust risk management practices that align your financial and emotional thresholds