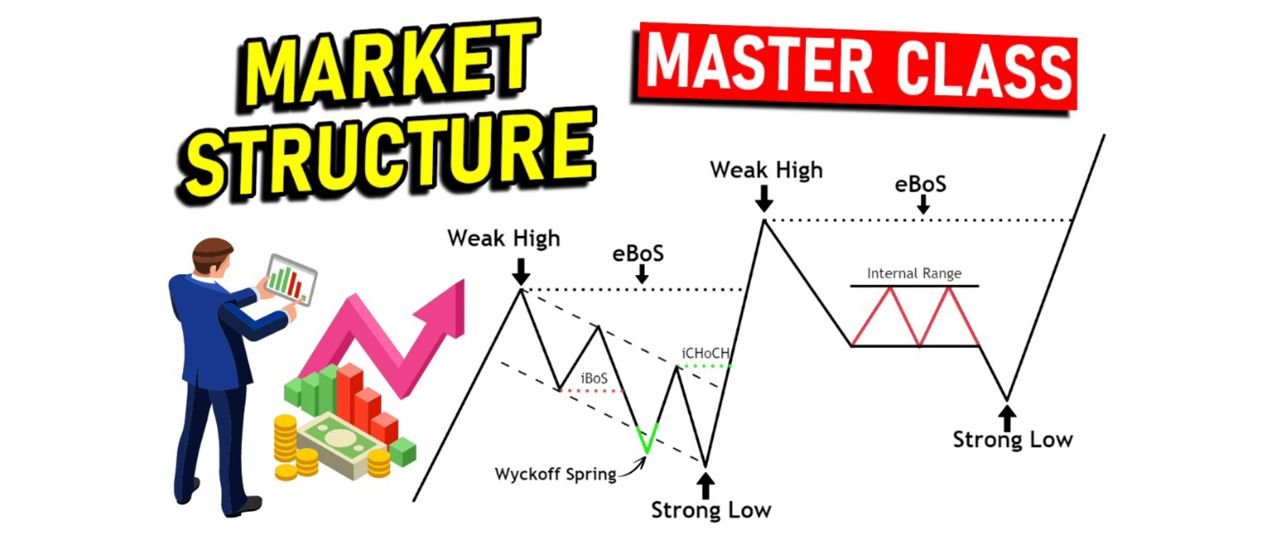

One of the most crucial concepts every trader must grasp is market structure.

Market structure refers to the way price moves in the financial markets — how trends form, break, and evolve over time. Understanding this can give you a massive edge in predicting future price movements and improving your overall trading strategy.

In this post, we’ll break down market structure, explain its key components, and show you how to use it to enhance your trading.

—

What is Market Structure?

Market structure refers to the organization and formation of price movements in a financial market. It’s essentially the big-picture framework that shapes the price action you see on your charts.

There are three primary market conditions:

1. Uptrend (Bullish Market): Prices are moving higher, and the market is making higher highs and higher lows.

2. Downtrend (Bearish Market): Prices are moving lower, and the market is making lower highs and lower lows.

3. Sideways Market (Consolidation/Range-bound): The market moves within a horizontal range, with no clear direction. This occurs when buyers and sellers are in equilibrium.

Understanding these trends and their key components will allow you to pinpoint trade opportunities and avoid being caught in a market that’s going nowhere.

—

Key Components of Market Structure

There are a few key elements that make up the market structure:

1. Higher Highs & Higher Lows (Uptrend)

In an uptrend, the market creates a sequence of higher highs (HH) and higher lows (HL).

A higher high occurs when the price reaches a point above the previous high.

A higher low is formed when the price dips but remains above the previous low.

This sequence indicates that the market is in a bullish phase, and traders look to buy when the price is near a higher low.

2. Lower Highs & Lower Lows (Downtrend)

In a downtrend, the market creates lower highs (LH) and lower lows (LL).

A lower high occurs when the price forms a peak lower than the previous high.

A lower low forms when the price drops below the previous low.

This sequence signals that the market is in a bearish phase, and traders look to sell when the price is near a lower high.

3. Support and Resistance Levels

Support and resistance are critical areas that define the market’s structure:

Support is the price level where buying pressure is strong enough to prevent the price from falling further.

Resistance is the price level where selling pressure is strong enough to stop the price from rising.

When the market is trending, support and resistance act as barriers for price action, and traders look for breakout or reversal opportunities at these levels.

—

Identifying Market Structure for Trade Opportunities

Now that you understand the key components of market structure, let’s explore how you can use this information for your trades:

1. Identify the Trend

First, identify whether the market is in an uptrend, downtrend, or consolidation. This helps you decide if you should be looking to buy, sell, or wait for a breakout.

2. Look for Price Action Patterns

Once you’ve identified the trend, look for key price action patterns such as:

Breakouts: Price moves above resistance or below support, signaling a continuation of the trend.

Reversals: Price shows signs of reversing direction, such as forming a double top or bottom.

3. Trade with the Trend

In general, you want to trade with the trend. The best opportunities typically occur when you buy in an uptrend near support (or a higher low) and sell in a downtrend near resistance (or a lower high).

4. Use Market Structure for Entry and Exit

Entry: Enter trades when price is at key levels like higher lows or lower highs, or when the market breaks above resistance or below support.

Exit: Exit your trades at logical price targets, like previous highs or lows, or when the market shows signs of a trend reversal.

—

Common Mistakes to Avoid with Market Structure

1. Ignoring Trend Reversals

Sometimes, the market breaks structure and reverses. Don’t ignore these signals! Always be aware of potential trend changes.

2. Overcomplicating Things

Market structure is simple once you get the hang of it. Don’t complicate it by looking for too many indicators or second-guessing price action.

3. Not Having a Clear Plan

Your understanding of market structure is only useful if you have a clear trading plan. Always combine market structure analysis with risk management to protect your capital.

—

Final Thoughts

Market structure is an essential tool for any trader. Whether you’re scalping, day trading, or swing trading, understanding the trends, support, resistance, and key price points will help you make more informed trading decisions.

Remember: Market structure helps you see the bigger picture, and understanding how to use it can be the difference between making profits and losing trades.

At ScalpersWorld, we provide you with more tips and strategies to help you build a stronger trading foundation. Stay tuned for more insights!

—

Ready to dive deeper?

Check out our next post: “How to Use Price Action with Market Structure.